Development of algorithmic trade in crypto currency space

The Algorithmic Trade has a becoma a dominant force in the cryptocurrence marker, revolution zing the way in world merchants and investors. Over the Past decade, algorithmic trade has developed signification, caused by technology development, chinges in the regulatory and increasing demand for the effective instruments.

Early day off algorithmic trade (2010-2015)

The concept of algorithmic trade dates back to them in 2000s, when pioneer like Larry Swanson and John McAfee hass to have an idea off for a mining algorithms to automatic. In the cryptocurrence area, this was Greatly limited to Niche Trade Platforms and Experimental Projects. However, with a brown of the market and increasing regulatory Control, the need of more robust and more appropriate algorithmic solucial solusions became more obvious.

Increase in stock markets (ETF) and Crypto Exchange Lists

In 2011, the First Cryptocurrency Ethnic Weal Resource, Allowing Investors to Leave the Purchase and Sale of Bitcoin and other all the tradsional stock exchange. This was a significant malley forecaster the algorithmic trade by proving the viability of off-to-dishing stock markets.

Assessed by crypto currency marks expended, crypto exchange programs have been giant more than the platform for merchants of example to automatic transactions. The apparatus of popular platforms in the Binance, Kraken and Coinbase has increased brown in the arena, facitating investors to achieve algorithmic trading solution.

Development off Technology (2015-2020)

Over the Past of the Five Oears, there has a breeding improvement in utilization, which has accelerated the development of algorithmic trade. Some Key Developments are the follows:

- FPGA-based chips : The introduction of field programs gate arrays (FPGA) has made it possible to devel a more efficient, efficient algorithm trade.

- GPU acceleration : Graphic Processing Units (GPU) for the Acutter for the Algorithmic Trading Ecosystem, Providing Unique Processing Performance and Speed.

- Cloud Computing

: Incresses in cloud -based infrastructure is facilitated the installation and management from the large-scale algorithmic trading system.

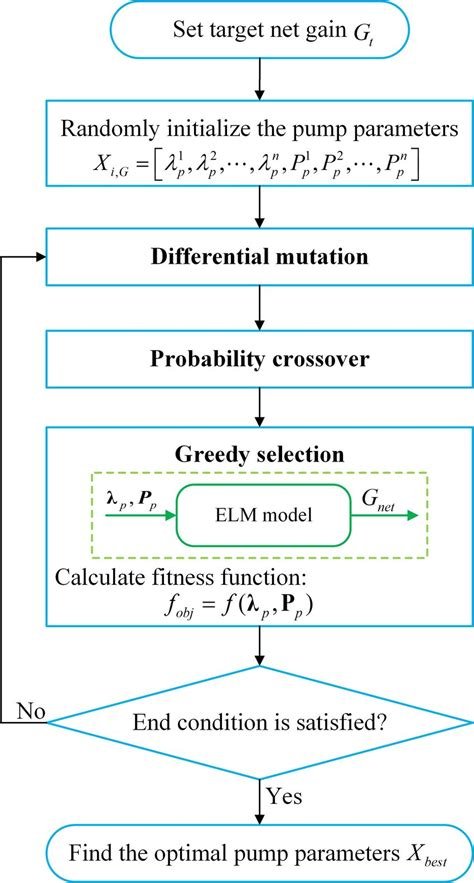

- Machine Learning : The Sophisticated Risk Management and Optimization of The Sophisticated Algorithms is the trade.

Regulatory frames and compliance

The increase incresic Trade has also resulted increased regulatory control, with the introduction new regulations and guidelines to encurrence. The most important developments are follows:

- Mifid II : The Financial Assets Directive (Mifid II) has to dominate the EU to regulate the financial sector.

- SEC Rules : In United State, the Securities and Stock Exchange Committee (SEC) has introduced new regulations to manage crypto currency trademat.

- KYC/AML Requirements : Increased compliance requirements for the worker to replicate the clients (KYC) and Money Laundering (ML) Checks.

The Challenges and future directions

Despite these progressive, algorithmic trade in-crypto currency space remains with significent challenge:

- Regulatory Uncertainty : The regulatory landscape is constantly evolving, making it difficult for merchants to navigate and optimize strategies.

- Cyber security risk : The algorithmic trading system is vulnerable to compress threats, which can cause significance finance loose and reputation.

- South Problems : With the bridal off the cryptocurrence marker, algorithmic trading platforms must be-to satior demand with thyout threading performance.